Raising Significant Capital

by Doug Schmidt | Jan 15, 2015 | Articles

Chessiecap Securities is pleased to announce a significant new capability for our clients: access to a rapidly evolving market of debt and equity capital from non-traditional funds. Over the past year, we have been developing this capability in conjunction with a highly regarded institutional research, sales and trading organization.

If you or your portfolio company will be looking for $10 million, $20 million, $100 million or more of growth capital or project financing, we have important sources for you to consider.2015 Raising Significant Capital

The rise of the “hedge” fund era in the past decade has severely disrupted traditional markets. Funds used to be divided neatly into silos such as venture, leveraged buyout, mutual, and fixed income. For many years, the versatile and lightly regulated hedge funds restricted their searches for yield to underperforming sectors and companies in the stock markets. Some hedge funds moved into riskier areas like PIPEs (private investment in public equity) and microcap stocks.

As many hedge funds outperformed traditional funds, the new hedge fund managers naturally began to attract large amounts of new capital. With more money, increased competition, and the regulatory freedom to quickly change their investment criteria, hedge funds evolved to spread their focus to every corner of the capital markets from real estate to energy to currencies.

The biggest change that we have seen in the last year, and one that we are pursuing aggressively, is that hedge funds are entering markets to supply non-public growth financing, project finance, M&A deal financing, and even, to a limited extent, venture investing. Along the way, the hedge funds have changed the behavior of traditional funds, so that when you look at the investment side of a major Wall Street investment bank or asset management company, you may wonder, “How do these established firms differ from giant, multi-purpose hedge funds?” That is a good question. The lines (silos) are blurring.

What we find in these new funds is an ability to make decisions far more quickly than traditional funds and a willingness to put enormous amounts of capital to work. Traditional private equity firms such as venture funds or LBO funds will argue that these new funds have plenty of bravado but no experience in the treacherous waters of private equity. ‘It will only be a matter of time before the mistakes and losses pile up.’ The new funds will argue that they represent a new paradigm, that they are faster and more nimble, and that they do not have the private equity fund cushion of high fees to rest upon. They say that they are just as smart as or smarter than traditional funds because they are hiring away much of the talent on Wall Street.

Rather than engage in this debate about who will be the winners and losers, we want you to take advantage of this unique competitive market and obtain the funds you need at potentially the lowest available cost for both equity and debt.

Chessiecap Securities is on the cutting edge of this dynamic market. From an institutional sales and research perspective, we have partnered with a firm that has scores of years of experience in providing investment opportunities to hedge funds and traditional funds alike. Together, we are seeking promising companies with significant capital needs in order to offer you potential access to these substantial sources of capital.

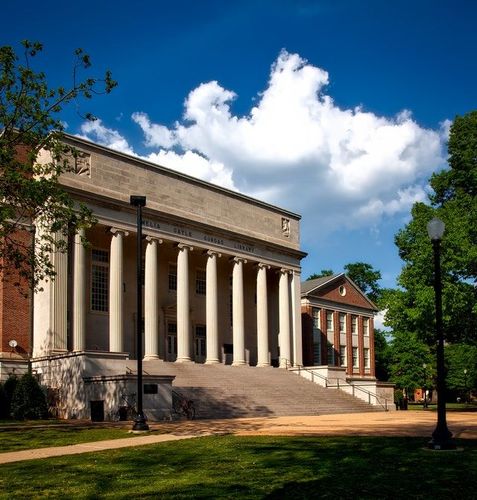

Chessiecap Securities, Inc.

3 Bethesda Metro Center, Suite 700

Bethesda, Maryland 20814

Member of FINRA and SIPC.

Chessiecap Securities, Inc. creates investment banking solutions for growth and technology companies throughout the U.S with a focus in the Mid-Atlantic region. We strive to achieve value and wealth for founders, investors and executives through Mergers & Acquisitions, Private Placements, and Corporate Finance/Development Services.