Indefinitive (adjective) – not definitive; not clearly fixed; indeterminate

You would think that the concept of “pre” and “post” money valuations would be the simplest of things to define…until a client calls with a set of complicating facts and asks you to explain what the pre- and post-money valuations are under those circumstances. Just such a thing occurred for me while driving to an event. I spent 45 minutes unpacking the mitigating attributes of a question that required focus on all the elements of a normal valuation. This is what I explained to my client.

In its simplest form, the math is pre-money valuation + new money/investment = post-money valuation. In the world of private company investing, the context of each of these three components influences the arithmetic. For the pre-money valuation, are you dealing with an existing known value as a frame of reference or are you negotiating a value from which other components are impacted:

- What was the valuation of the last round of investment immediately before new money is invested? This is the KNOWN pre-money value. It is most easily stated as the price per share paid in the last round multiplied by the full-diluted number of shares outstanding after the investment is made. The product is important because it establishes whether or not a new investment is being done as a down round triggering antidilution provisions.

OR… - What is the pre-money valuation that the new investor is prepared to offer for its new investment? This is the NEGOTIATED pre-money value. It is most frequently stated as the aggregate valuation assigned (ex. $10,000,000) before the new investment is made (ex. $5,000,000). In this example, the investor is proposing to set the pre-money value for the purpose of receiving one-third ownership of the company:

$5mm ÷ ($5mm + $10mm) = 1/3rd

Simple enough. Are you using an unambiguous value as a reference point in the past or negotiating a starting point based on multiples of revenue/earnings or other metrics? The first potential source of misunderstanding is whether you are referring to the aggregate valuation or the per share value which requires an agreement of how many shares are outstanding in the calculation.

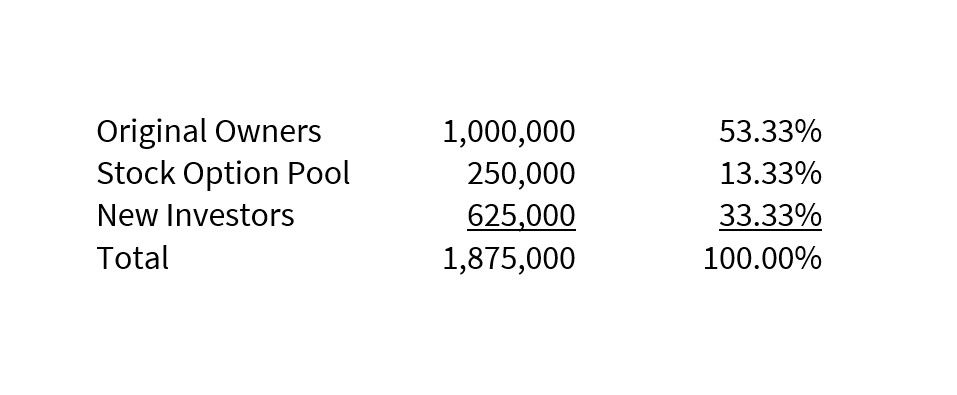

The next item in the equation should be the simplest…how much is the new investment? Adding the new money to the pre-money valuation should arrive at the post-money valuation. But this is where in the venture capital world that the first of several “adjustments” takes place. Taking the example above, let’s assume the pre-investment fully-diluted number of shares was 1,000,000 making the $10 million pre-money valuation equivalent to be $10/share. However, as a condition of their investment, the new investor wants the company to establish a pool of 250,000 stock options to be used for post investment new employee recruitment and retention. In other words, the new investor wants the existing investors to bear the brunt of the dilution of this stock option pool BEFORE the new investment is included in the fully-diluted share count. A revised calculation now looks like:

$10,000,000 ÷ (1,000,000 + 250,000) = $8.00/share

While the pre-money aggregate valuation has not changed, the pre-money price per share has dropped from $10 to $8. So, the meaning of this is that $5mm investment will get 625,000 shares or:

A quick sidenote about venture capital valuation math. All stock options, warrants, convertible notes, and other contingent stock issuances are treated as if fully exercised in calculating the number of fully-diluted shares. For the accounting geeks reading this, there is no “treasury stock method” of accounting for adjusting the dilutive effect of unexercised contingent shares in venture capital calculations. And yes, this works out nicely for the investor if the option pool is not fully utilized at harvest time.

Alas, confusion sets in. We spend most of our time negotiating absolute dollar valuations using market multiples and negotiating what percentage of the company will be owned by founders and new investors. But never forget that the investment documents signed by the parties rarely mentions percentages. The stock purchase agreement usually says how many shares of stock are being purchased for an agreed price per share. In this case 625,000 shares at $8.00 per share for a total of $5mm. Always convert the various other aggregate numbers (valuations and percentages) into the denominator of the per share price to avoid misunderstandings between the parties.

I mentioned at the beginning that this explanation was prompted by a client trying to reconcile pre- and post-money valuations in their peculiar circumstance. In this situation, the aggregate pre-money valuation was previously negotiated and deemed to be sacrosanct. The new investment was actually a conversion of convertible notes into shares based on the ratio of (1) principal + accrued interest of the notes over (2) the post-money valuation of adding the notes (in 1) to the negotiated pre-money valuation. In converting the convertible notes into shares, my client used a conversion price based on a price per share that existed at the time the pre-money valuation was set, but had failed to factor in antidilution issuances of additional shares that were created after the valuation was set. As a result of the incorrect conversion price, the convertible notes were converted into more shares than they were entitled to.

Bradford Harries is a partner of Chessiecap, Inc., an investment banking firm providing capital raising, M&A and other corporate finance services. He is a graduate of Stanford University with an AB in Economics and MBA. His Wall Street career began in 1979 and has particular expertise with respect to technology and emerging growth industries.